Trade Aptitude

Results of Tuesday’s Best S&P Futures Turning Points: Neither trade triggered. The levels remain on the chart.

Today’s Best S&P Futures Turning Points (consider wider stops and less size in fast moving markets):

Buy 4181.75 stop 4177.50. Short 4305.00 stop 4309.00.

The World Index: (+100/-100) drops from +21 to zero in a world of mixed sentiment and low volatility.

Catalysts: New Home Sales @ 10:00. Crude Oil Inventories @ 10:30. Earnings from 251 companies including META after the close.

Quick Tip: Confirmation

Here’s a great quote from Jesse Livermore that deserves your attention, “"Do not anticipate and move without market confirmation—being a little late in your trade is your insurance that you are right or wrong."

In our effort to succeed we can devote too much effort to predicting the future. Good luck. The problem is that our predictions are correct just enough to...

Trade Aptitude

Results of Tuesday’s Best S&P Futures Turning Points: Neither trade suggestion triggered in a narrow range day.

Today’s Best S&P Futures Turning Points (consider wider stops and less size in fast moving markets):

Buy 4551.75 stop 4547.25. Short 4598.50 stop 4605.50.

The World Sentiment Index: (+100/-100) drops from -36 to -86 with all major world markets very Bearish.

Catalysts: ADP Payrolls @ 8:15. Crude Inventories @ 10:30. US Debt downgraded.

Quick Tip: When to Follow

As Thomas Paine said, “Lead, follow, or get out of the way.” How does this apply to trading?

From a stock trading perspective “leading” implies one has performed exhaustive research and has uncovered a stock that has positive fundamental, technical, and marketplace metrics. The analyst knows nearly as much as the executives running the company about its prospects, but not all...

Trade Aptitude

Results of Monday’s Best S&P Futures Turning Points: Neither trade suggestion triggered and remain on the chart.

Today’s Best S&P Futures Turning Points (consider wider stops and less size in fast moving markets):

Buy 4182.00 stop 4178.75. Short 4229.75 stop 4233.50.

The World Sentiment Index: (+100/-100) PLUMMETS from +14 to -50 with most major world markets Bearish.

Catalysts: Fed-speak @ 9:00. PMI Flash @ 9:45. New Home Sales @ 10:00. No deal from the White House but both agreed that a default is not going to happen.

Quick Tip: Be proactive, not reactive.

With 40+ million copies sold and a release date in 1989 you’re likely to have read Stephen Covey’s “The 7 Habits of Highly Effective People.” If not, do it now. It is excellent and timeless advice.

Habit #1 says be proactive, not reactive. With so many different styles of trading, you know there are strategies that you...

The Daily Market Forecast... Expectations

Thursday’s Results: Neither trade triggered.

Quick Tip: Expectations

“What are you struggling with?” was the question I asked a group of traders recently. One woman said she had expectation challenges. She felt she needed to acknowledge that every trade cannot be a home run, or “10 to 1” as she phrased it.

I respect her self-awareness. Expectations is not a commonly voiced trading challenge. But it is real. You can expect too much and foster disappointment. You can expect too little and minimize your profits. Neither view is healthy for your ultimate results.

If you are documenting all the trades of your strategies (taken or not) then you will have hard evidence and know what to expect most of the time. The challenge arises when the market changes character and you are still “expecting” something different to happen.

In “The Disciplined Trader” by the late Mark Douglas, he identifies nine critical trading skills.

#6 - Learning...

The Daily Market Forecast... Steps

Wednesday’s Results: Neither trade triggered.

Quick Tip: Steps

Without goals people drift through life never achieving their true potential. This is not opinion but documented fact from numerous psychological studies. No goals? No progress.

Small and “reasonable” goals are typical for most people if they bother to set goals at all. Yet, they require the same attention as big and “audacious” goals. Really. But there is a difference in the path. The execution.

You’re reading a trading blog so let’s assume you want to achieve the goal of being a consistent, profitable trader.

- Ignore the urge to set a small and “reasonable” goal. That may be something like earn $1000 per month from your trading. It’s not enough to keep you trying. You’ll likely quit before you get there because the reward you seek is not compelling enough to you. Why suffer up the learning curve for $1000 per month?

- Set the big audacious goal first. The...

The Daily Market Forecast... Embrace Change

Tuesday’s Blog Levels: Neither trade triggered.

Quick Tip: Embrace change.

Successful investors and traders alike have a rule-based strategy that provides them a financial advantage or “edge.” A combination of fundamental and technical analysis are typical components. Another analysis you can add to the recipe is investor “mood” commonly called sentiment. In other words, do market participants feel bullish, bearish or neutral about the future?

While every region and country has a unique economy, given the volume of international trade those individual economies are part of a larger “global” economy. The U.S. economy is the largest in the world but more importantly for us it is also the last market traded on the daily clock. This allows U.S. traders a glimpse at how the Asian and European markets are trading before our stock market opens.

Many years ago, I developed a simple indicator for world sentiment, which I call the World Index. The...

The Daily Market Forecast... Powerful Habit

Monday’s Blog Levels: The short idea never triggered and the market opened below the long idea.

Quick Tip: Powerful Habit

Do you know anyone who read the Bible, Quran, Torah, or Vedas only once? (Sorry if I missed your faith but you’ll get the point in a moment).

You read anything enlightening once… “Interesting! I didn’t know that. I’m definitely following this advice!”

Result: A few days of spotty application. Your experience is now called “history.” You didn’t change.

You read anything enlightening a few times… “I’m getting this. I see how it’s changing me for the better. I feel calmer, more intelligent, motivated. Wow!”

Result: You have some new habits. You’re seriously applying. Your experience is now called “real.” You’re changing.

You re-read anything enlightening regularly… “I knew that and forgot it! Studying this needs to be on my calendar....

Daily Traders Blog - Whipping Fear

Subject: Whipping fear.

You know that a confident trader is a winning trader, and a fearful trader is a losing trader. Part of your personal development plan should be eliminating your fears. Yes, fears. Plural. You can have more than one. Over the years teaching traders I’ve noticed different types of fear.

- The most obvious is fear of loss. Managing your risk, pre-determining your “risk number” (the amount that negatively affects you either financially or psychologically) is the simple answer. Everyone can do this.

- Fear of being wrong. This is a huge problem with traders and not so obvious. Look back to grade school. The teacher asked the class a question and only a few hands were raised. Not yours. Did you not know the answer? Or were you scared to be wrong in front of your friends? Fear of being wrong paralyzes some traders even when their risk number doesn’t.

- Fear of not being in control. We all know people who are most comfortable when in control. They...

Purposeful Trading Part 1

By Dr. Woody Johnson

Paulo breathed a heavy sigh as he thought about the next day’s preparation. He was still attempting to recover from today’s session, which was emotionally whipping him as my grandfather used to say, “…like he stole something!” He felt fragmented and frustrated. He knew that his research and preparation for tomorrow’s trading was crucial. Paulo also knew that his state of mind was not conducive to the sharp focus of his A-Game, which was required for preparation that was not distorted by poor judgment or distracted by noisy thinking.

He had several mental/emotional tools that he could use when his emotional temperature was too extreme for making prudent decisions. But he was so disgusted with his results from this day’s trading, which included several losses, two rule violations and a premature exit that left him at break-even only to watch the price action move decidedly in his direction...

The Daily Market Forecast... confidence

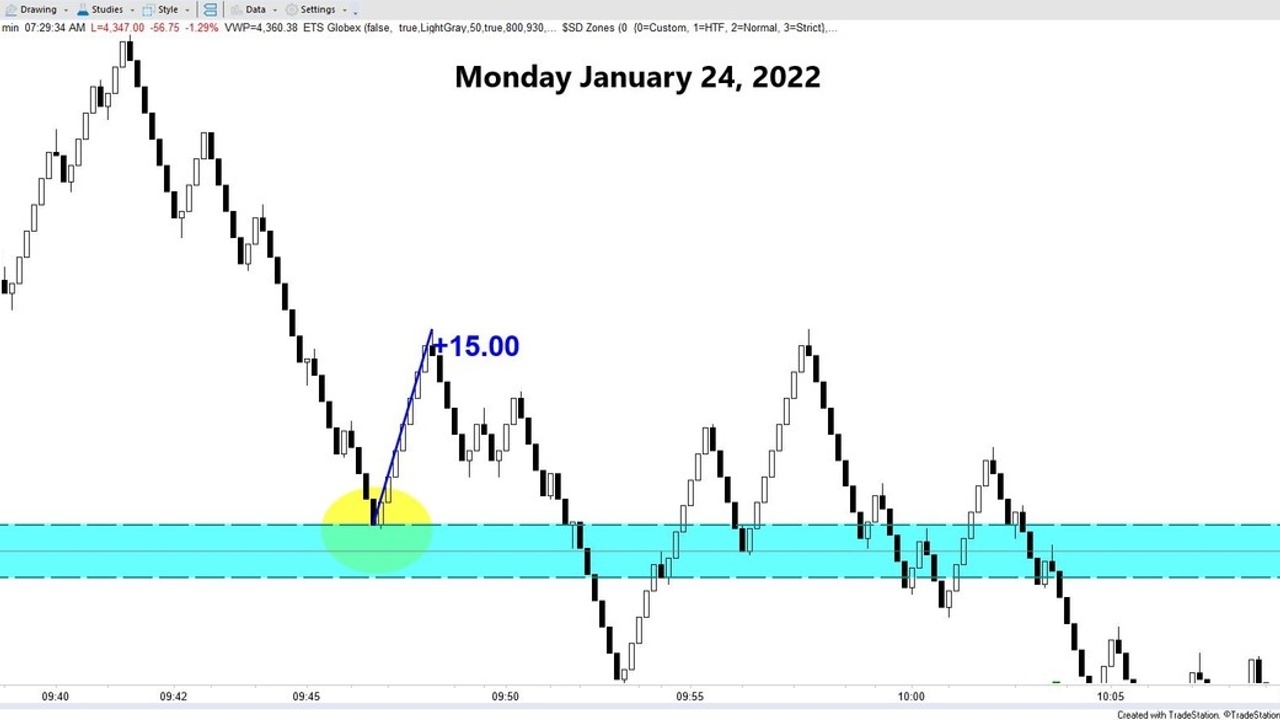

Monday’s Blog Results: What a day! The suggested buy level at 4303.00 was good for a 15-point bounce. Not much on a 198-point range day, but that was only one of 28 setups the Team here saw get filled.

Today’s Lesson: Have confidence.

Before you can have confidence as a trader you need to be confident in your rules. There is a difference.

The way you get confidence in your rules is to perform deep research in all market conditions. Document thousands of trade setups. Look for edge based on probabilities.

The way you get confidence in your trading is to stop thinking you can “beat” the probabilities and just follow the rules like a machine.

Yesterday is a great example. The S&P sold off hard dropping almost 5% (from high to low). It gained all that back to close higher. During the plunge you might have been thinking “There is no way I’m taking a buy signal and trying to catch this falling knife.” Big miss with that thought, huh? Volume...