Trade Aptitude

Friday’s Best S&P Turning Points Results: Price chopped to a higher close without reaching the suggested levels (still look good).

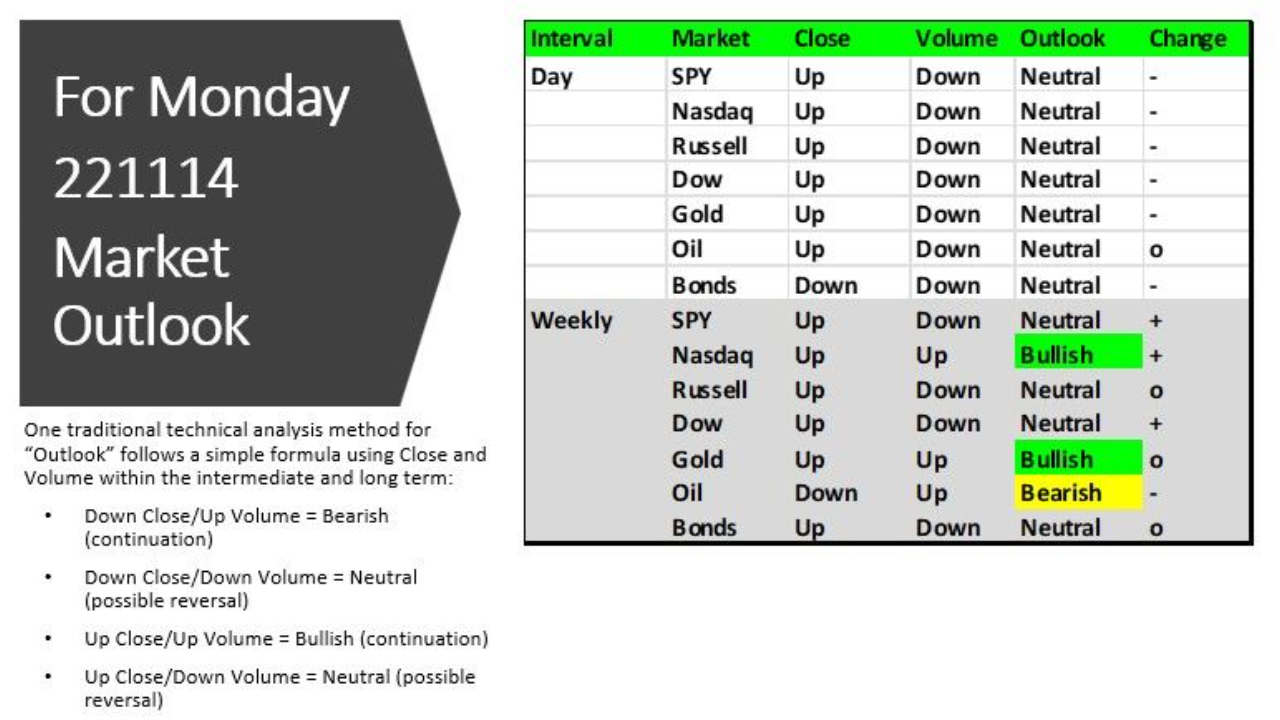

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Short 4052.25 stop 4056.00. Buy 3916.25 stop 3911.75

The World Sentiment Index: (+100/-100) DROPS from +57 to +21 in a world of mixed sentiment. Historically prices closes higher than the open 55% of the time.

Catalysts: Nothing on the economic calendar. Scattered Fed-speak.

Quick Tip: Drop the Ego

One of the hardest transitions to make as a trader is the reframing of your belief about winning and losing. We were raised defining winning as good and losing as bad. Now we must change that belief.

Mark Douglas, author of two books on trading psychology said, “When you really believe that trading is simply a probability game, concepts like right or wrong or win or lose no longer have the same significance.”

Curtis Faith, one of the original Turtle Traders ...

Trade Aptitude

Thursday’s Best S&P Turning Points Results: The buy never triggered, the short was filtered out on CPI news reaction.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Short 4052.25 stop 4056.00. Buy 3916.25 stop 3911.75

The World Sentiment Index: (+100/-100) SOARS from -29 to +57 with most major world markets bullish, especially China/Hong Kong (+7.74%). Historically price closes LOWER than the open 54% of the time.

Catalysts: Consumer Sentiment @ 10:00. Risk ON, but not in cryptos thanks to FTX. Musk mentioned bankruptcy for Twitter. :-0

Quick Tip: Trade Filters

It’s easy to look at a day like yesterday when the equity indexes soared to rare percentage gains and feel FOMO. Keep in mind that the #1 focus of every surviving trader is risk management. Allowing greed to take charge will eventually blow up your account.

The CPI report created extreme volatility negating trade entry on the 3833.25 short level. The volume levels presente...

Trade Aptitude

Wednesday’s Best S&P Turning Points Results: The buy suggestion @ 3792.25, a repeat from the prior day after missing fill by 2 ticks, ran for 24.75 points.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Short 3833.25 stop 3837.75. Buy 3674.00 stop 3668.25.

The World Sentiment Index: (+100/-100) RISES from -57 to -29 in a world of mixed sentiment. Historically prices closes higher than the open 56% of the time.

Catalysts: CPI & Jobless Claims @ 8:30. After that, election results and Crypto problems.

Quick Tip: Coming Back

Baseball great Harmon Killebrew said, “The most important athletic ability is the talent to comeback from behind.” True in sports, true in business, very true in trading.

The great come-back athletes were different than their peers. They knew there would be setbacks. They thought in advance how to handle them. They didn’t get emotional. They snapped to attention and worked their plan.

What’s your comeback plan...

Trade Aptitude

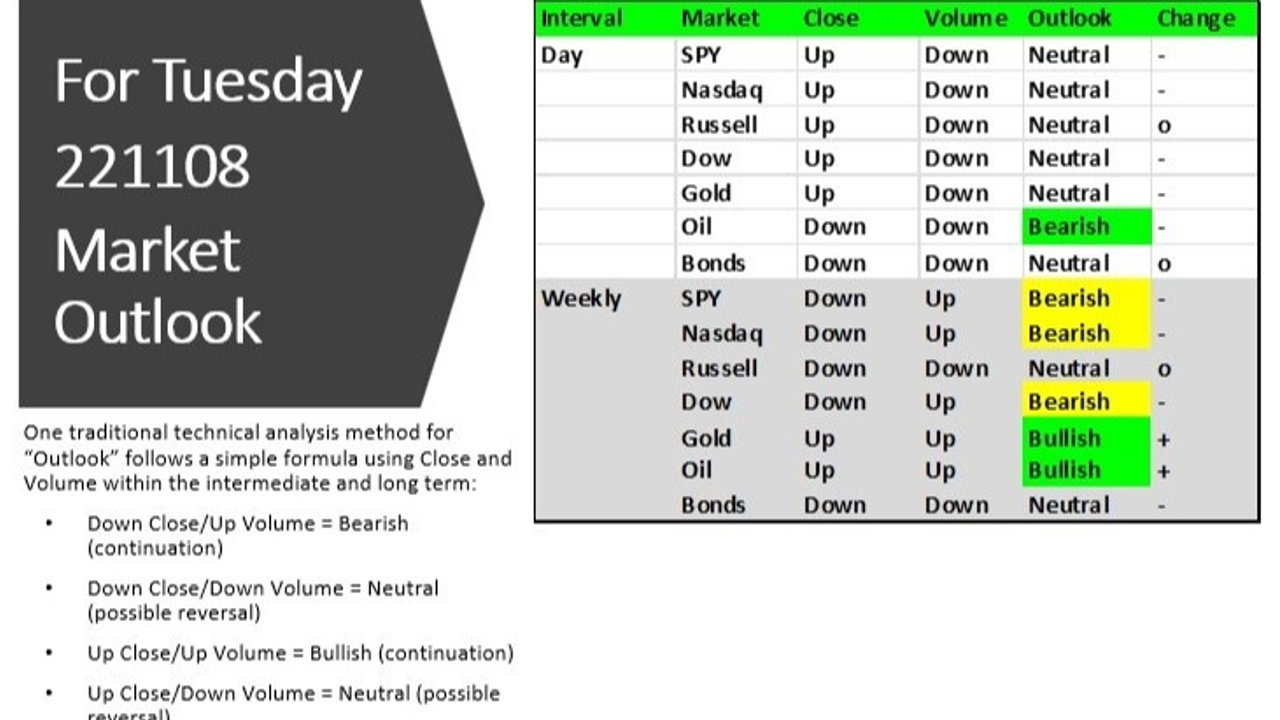

Tuesday’s Best S&P Turning Points Results: The short suggestion @ 3843.25 stopped out. The buy suggestion @ 3792.25 missed fill at the bottom of the day by 2 ticks and ran for 63.75 points. Reframe your thinking... the level worked.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Short 3923.25 stop 3928.25. Buy 3792.25 stop 3786.50.

The World Sentiment Index: (+100/-100) DROPS from +7 to -57 with all major world markets bearish. Historically there prices closes lower than the open 56% of the time.

Catalysts: EIA Petroleum Status Report @ 10:30. Risk off mood. Waiting on CPI.

Quick Tip: Rich & Quick Don’t Mix

A favorite book of mine is “The Road Less Stupid” from esteemed business manager Keith Cunningham. I bought it before knowing what it was about because the title was all I needed to read. You absolutely MUST get something beneficial from a book with that name!

It ends up being great advice on starting and running a business. So...

Trade Aptitude

Monday’s Best S&P Turning Points Results: Neither trade suggestion triggered.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Short 3843.25 stop 3849.00. Buy 3792.25 stop 3786.50.

The World Sentiment Index: (+100/-100) DROPS from +50 to +7 in a world of mixed sentiment and low volatility. Historically there is no edge with this score.

Catalysts: Nothing on the economic calendar. Elections and CPI on Thursday are the drivers this week.

Quick Tip: Fear & Greed Solved?

Money messes with our heads. Until you get a grip on the emotions associated with trading, you’re unlikely to succeed.

Here’s a viewpoint I learned from one of the all-time great traders, Larry Williams: “More money is lost due to overstaying positions (greed) than exiting due to the fear of losing money.”

Fear is solved by using stops that lose an amount of money you can accept. Easy enough.

If Larry is correct, and I do believe he is, then greed is solved by pre-...

Trade Aptitude

Friday’s Best S&P Turning Points Results: Neither trade suggestion triggered.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Short 3843.25 stop 3849.00. Buy 3728.25 stop 3724.00.

The World Sentiment Index: (+100/-100) EASES from +64 to +50 with most major world markets bullish. Historically the market closes lower from the open 54% of the time.

Catalysts: Nothing on the economic calendar. Elections and CPI on Thursday are the drivers this week. Tech layoffs, lowered earnings estimates.

Quick Tip: Intra-day Trend

If you look at a 15-minute chart of the S&P Futures from Friday you wouldn’t call it a “trending” day. It was smoothly higher during the Globex session and then reacted violently to the payrolls report swinging down, up, down, up, down and ending modestly up.

Trend is time-frame dependent, though. In our trading room we use a proprietary intra-day trend strategy on a volume bar chart. The swings were captured nicely prod...

Trade Aptitude

|

Trade Aptitude

Tuesday’s Best S&P Turning Points Results: Buying the 3886.00 level only offered a 9.25-point gain. Shorting the breakout offered a 28.25-point runner.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Waiting on FOMC to determine potential turning points. Join us for LIVE trading during the announcement @ 2PM ET. Click here to register for this free demo.

The World Sentiment Index: (+100/-100) PLUMMETS from +86 to +7 in a world of mixed sentiment. Historically it’s a coin toss on direction. No edge.

Catalysts: Maybe ADP Employment Report @ 8:15. EIA Petroleum Status Report @ 10:30. FOMC Announcement @ 14:00 and Press Conference @ 14:30.

Quick Tip: Gold on FOMC

FOMC today. The mother of all catalysts. The stock market indexes will react violently offering some great opportunities if you’re willing to wait for the spread and slippage to calm down.

Another market that moves well and not quite as violently during FOMC interest rate...

Trade Aptitude

Monday’s Best S&P Turning Points Results: Narrow range day yesterday, neither trade idea triggered.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Short 3966.50 stop 3971.25. Buy 3886.00 stop 3880.25

The World Sentiment Index: (+100/-100) SOARS from zero to +86 with all major world markets bullish, especially China/Hong Kong. Historically the close is higher than the open 63% of the time.

Catalysts: PMI MFG Final @ 9:45. ISM MFG Index, Construction Spending & JOLTS @ 10:00. Dollar eases. Yield curve near recession warning. Waiting on FOMC Wednesday.

Quick Tip: The Big Problem

Are you working on solving it? Most traders aren’t. Why? Because it’s hard. It’s a challenge. It’s the single most impactful change you can make to improve your trading performance. Most people would do anything else rather than solve the one problem that needs to get handled pronto.

If you know what your problem is, your entire focus should be on fixing i...

Trade Aptitude

Friday’s Best S&P Turning Points Results: The suggested short level was only good for a 7.25-point scalp.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Short 3966.50 stop 3971.25. Buy 3849.50 stop 3843.75.

The World Sentiment Index: (+100/-100) SOARS from -64 to zero in a world of mixed sentiment. Historically it’s coin toss where we’ll end up. No edge to report.

Catalysts: Chicago PMI @ 9:45. Waiting on FOMC Wednesday.

Quick Tip: Exit Art

In teaching over 4000 traders in the past 13 years I’ve found the most common goal is finding better trade setups. It seems we naturally want to know when, where and with what are we going to get started. Entry rules.

The fact is that entries are easy to find. Investing much of your research time on finding better entries is not nearly as productive as finding better exits.

Why? Because you win or lose on the exit you choose. It is the most important rule set in your plan. You should be t...