The Daily Market Forecast... contrary is good

Friday’s Blog Results: The suggested short stopped out for a 4.25-point loss (per contract). The long didn’t trigger.

Quick Tip: Contrary is good.

The Wall Street definition of a correction in the market is a 10% drop from the high. All indexes but the Dow did that last week. A possible short-covering rally late in the week repaired the situation.

What’s next is anyone’s guess but looking at evidence from past performance can be useful. Here are some interesting S&P statistics that may help you with your long-term portfolio plans (day traders don’t care about this).

In the past 33 corrections the S&P went on to Bear territory 7 times. The other 79% of the time it reversed to new highs.

The average correction was -15%. We hit that last week. The average Bear market was -36%.

Moving over to the Dow, in the past 29 events of global crisis (think wars, terrorism, Covid, Ukraine), the average drop was 11.6%. After 3 months it was up 11.3%, 6 months up 15.8%, 12 months up 24.7%.

Today...

The Daily Market Forecast... wonder beats belief

Thursday’s Blog Results: The long level never triggered and the short level at 4222.00 was only good for a 4.75-point scalp before stopping out.

Quick Tip: Wonder beats Belief

Here’s a quote I love from superstar attorney Gerry Spence: “I would rather have a mind that is opened by wonder than one closed by belief.”

At first this quote seems to simply say “Have an open mind.” But it goes deeper than that. It’s more than merely having a positive attitude or not being fixed by your own opinion.

The word “wonder” is key. You can have an open mind that is limited. There are degrees of openness. It is almost like an oscillator that pegs in both directions. You have a self-imposed limit on how much you’ll be open to. And that limit is your belief. Because when the openness closes it does so from your limiting belief. Thus, no one is completely “open minded.”

In trading there are many strategies that have edge. There is no “best way.” You need to be open minded enough to explore many dif...

The Daily Market Forecast... journal more

Wednesday’s Blog Results: Neither of the suggested levels triggered.

Quick Tip: Journal more.

Review is an important process to improve your performance (at anything). In trading the dedicated few who review every day start with their charts. The really dedicated trader will keep and review a “thought journal.”

How did you feel that day? What was going through you mind when you were entering trades, exiting trades, winning, losing, making mistakes, being perfect? The list goes on.

Here’s an example, albeit highly personal and not intended as advice, about trading during extreme adversity. You know, like the day after Russia invades Ukraine? War. I thought that kind of thing was over. We grew up. Got educated. Found wisdom. I guess not all of us. ☹

Excuse the digression. In my thought journal I notice that during extreme market moves I get loose with my rules. Feels like greed, thrill, and fear all at once. Knowing this and reviewing these sessions this morning will likely save m...

The Daily Market Forecast... scale in

Tuesday’s Blog Results: The suggested long level at 4285.50 bounced for 10.50 points.

Quick Tip: Scale in.

Consider the entry on the trade above. Price reversed right on the entry. No down money. If you were trying to reduce your risk by moving the entry deeper in the price level you would have missed the winner.

For our Volume Profile strategy, price penetrates the level by a maximum of 1 point 31% of the time before it continues in your desired direction. Think about it. If you’re not entering early you’re giving up 31% of your winning/breakeven trades! It’s way better to move your STOP in from the other side.

Another way to address this is scaling into the trade as it goes against you. Let’s say you’re a 6-contract trader. Entering 3 at the level and the remaining 3 as price moves against you little you’re reducing your risk and increasing your reward. The downside is when price does rocket in your direction you’ll have less size in the trade. Depending on market conditions, you...

The Daily Market Forecast... optimizing stops

Friday’s Blog Results: The suggested buy @ 4360.00 ran for 30.25 points with only two ticks of adverse move.

Quick Tip: Optimizing stops.

Remember this from last issue? “Stops are so easy. Pick your risk number. That gives you position size. Hit enter.”

True enough but there is still the decision as to WHERE the stop should be placed. There are plenty of popular methods that the books, Google or YouTube can teach you. This blog is about OPTIMIZING the stop method you’re already using.

Let’s say your preferred stop method is a fixed number you’re willing to lose. Here’s how to optimize it: Log the MAE (Maximum Adverse Excursion) for every trade setup, whether you took the trade or not. This is simply how far against your entry it went before stopping out or hitting your first profit target.

Obviously, the maximum MAE you’ll have is the stop itself. But on all those winning and breakeven trades there is a number it went against but didn’t reach the stop. This is important data. Keep...

The Daily Market Forecast... optimizing targets

Thursday’s Blog Results: The long level triggered and popped for 4.25-point scalp. Did you stop out or get dinner money?

Quick Tip: Optimizing targets.

Stops are so easy. Pick your risk number. That gives you position size. Hit enter.

Targets are elusive. The Trading Gods made it that way, I think. And it gets worse if you’re a day trader and watching the chart!

If you ask yourself what would be the best stat to know when you enter a trade, eventually you’ll come to the answer that matters… how far in my direction will it go? This is called Maximum Favorable Excursion (MFE). We’ll never know this but we can use probabilities to help our target placement.

Here’s how: Based on your rules for entry and exit, log the MFE for every trade starting today. You should do this for every trade setup your strategy presents, whether you took the trade or not. If you have the ability to go back and add this to prior trades, spend the whole weekend doing it.

Once you have a sizable dataset (at ...

The Daily Market Forecast... move stop?

Wednesday’s Blog Results: The short never triggered and the long was a… problem. Here’s why. The blog arrives around 8AM ET and a whole lot can happen between then and the open. The suggested long was invalid at the open as price dropped well below after the economic news.

The team had a level that ran for 13.75 points, but price was very spiky all the way, so the gain really depended on how they managed their trailing stop, if any (see chart above).

Quick Tip: Stops… move or not?

You’ve heard both, I’m guessing. I know very successful traders that have opposing views on this subject. It’s no surprise that you heard conflicting advice.

The correct answer is not simple, though. You must take it in context. You need to know their trading style and risk tolerance to truly understand their answer.

Trader A enters momentum moves and adds to her position as price goes in her direction. She trails her stop based on chart features and volatility.

Trader B trades a reversal strategy that...

The Daily Market Forecast... do something.

Tuesday’s Blog Results: Neither suggested level triggered.

Quick Tip: Do something.

Yesterday was “Do nothing” today is “Do something,” what’s going on?

There are many trading styles to choose from. Saying one is the “best” is foolish. It may be the best for someone, but no trading style is best for everyone. While yesterday’s quote came from Jim Rogers suggesting you do nothing between great trades it is his style (very long term). “Doing something” works too.

Out team of traders share best practices for multiple strategies. Volume Profile, Breakouts, Volatility Reversal, Supply/Demand, Directional Options, and Spreads. Not everyone trades all the strategies. You should find the style of trading that resonates with your personality and risk tolerance and stick to it.

But if you have the ability to trade multiple styles (strategies) here are the pros and cons:

Pros:

- More trading opportunities. When one strategy is waiting for entry, another may be active. This means more effic ...

The Daily Market Forecast... do nothing.

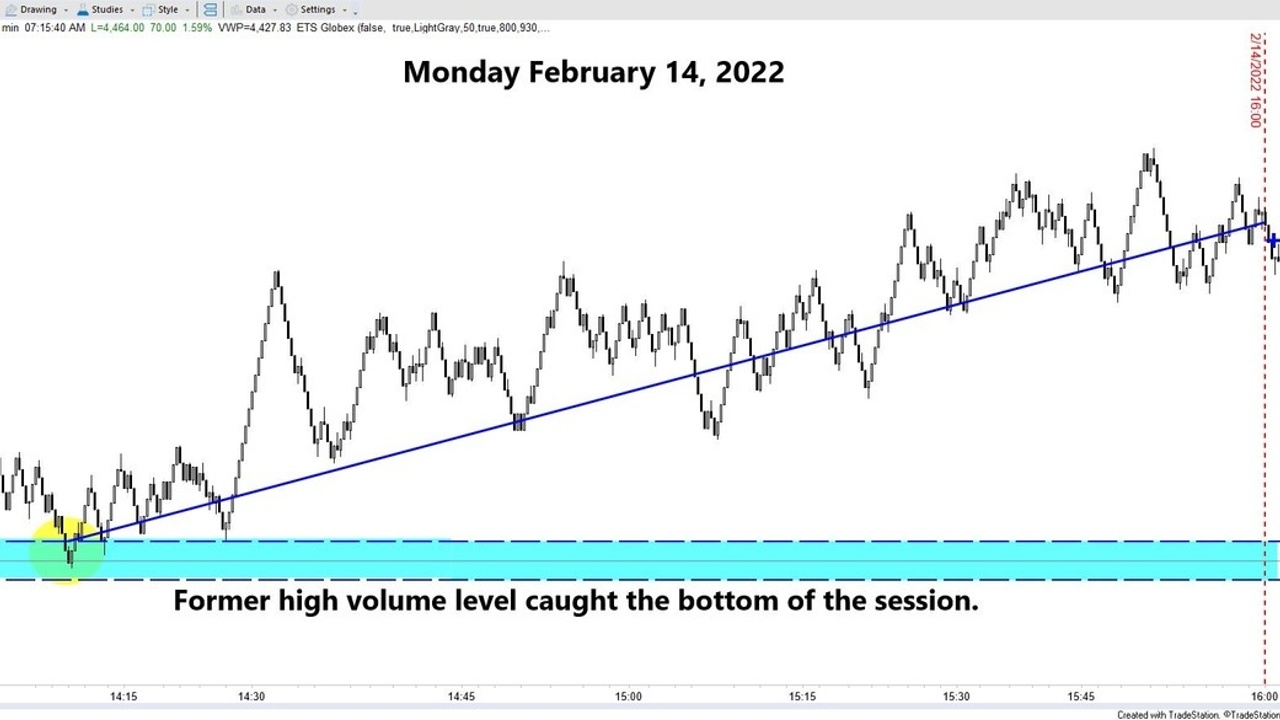

Monday’s Blog Results: Neither suggested volume level triggered. Team members saw price reverse on a former high-volume level running for 37.25 points.

Quick Tip: Do nothing.

Successful trading skills are very different than how we’ve been conditioned to behave.

Here’s an example via some advice from arguably one of the best traders in history, Jim Rogers.

“I just wait until there is money lying in the corner, and all I have to do is go over there and pick it up. I do nothing in the meantime."

Who was taught this concept growing up? Did Dad ever say, “Do nothing?” Mom? Your boss?

OK… I’m taking literary license here because we all know Jim didn’t vegetate between trades. But what IS important is he didn’t trade. Research? Sure. Study? Yup. Plenty of productive tasks we can do while waiting for the “money lying in the corner.”

Get comfortable with the idea of being a trader who can “not trade.”

Today’s Best S&P Futures Turning Points:

Short Level: Sell 4497.50 stop 4503.25 (sam...

The Daily Market Forecast... F.E.A.R.

Friday’s Blog Results: The suggested short caught the top of the day session and ran for 41.75 points to the next volume level. Team members knew about the 4174 level and saw that bounce 15.75 points.

Today’s Lesson: F.E.A.R.

Trading breeds emotions. It’s all about the money and most of us have emotional reactions to money. While greed is a killer, fear of loss is also serious problem for unskilled traders.

There is an acronym for “fear” that is important here. F.E.A.R. stands for False Evidence Appearing Real.

The chart above shows a good example of this. Looking at price soaring straight up you might be fearful of taking the suggested short at 4515.75. Your fear would have kept you out of a 41.75-point runner. Not good.

You might be thinking “What’s so false about this rally? It looks very real!”

The fact is strong moves in one direction will usually correct in the opposite direction rather violently. Scan hundreds of charts and see for yourself. The reality behind this phenome...