Trade Aptitude

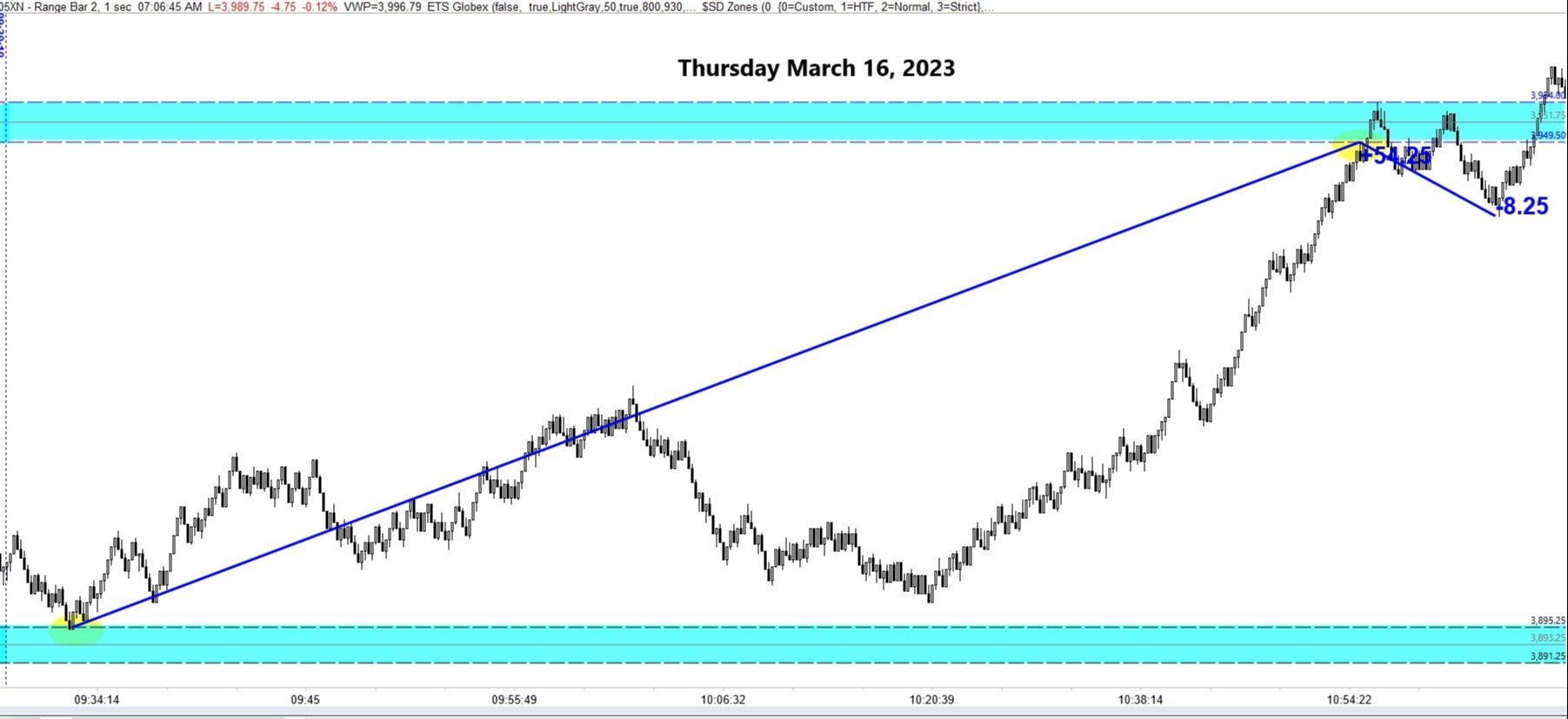

Results of Thursday’s Best S&P Turning Points: Buying 3895.25 picked the bottom of the session and ran for 54.25 points to the suggested short @ 3949.50, which only offered an 8.25-point reversal. Feel better about the win by donating a slice to my preferred charity, the Alzheimer’s Association. Click here.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Buy 3913.50 stop 3908.25. Short 4073.50 stop 4077.50.

The World Sentiment Index: (+100/-100) SOARS from -14 to +50 with all major world markets bullish while the S&P futures are lagging. Historically the market closed lower than the open 58% of the time.

Catalysts: Industrial Production @ 9:15. Consumer Sentiment (including preliminary Inflation) @ 10:00. Co-opetition among big banks suggests the banking problem isn’t over. Fed chips in, too.

Quick Tip: Getting Lucky

Happy St. Patrick’s Day! The perfect time to discuss luck in trading. Does it exist? Of course. From a mathematics ...

Trade Aptitude

Results of Wednesday’s Best S&P Turning Points: Neither suggested trade triggered.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Buy 3895.25 stop 3890.50. Short 3949.50 stop 3954.75.

The World Sentiment Index: (+100/-100) drops from -43 to -14 in a world of mixed sentiment, Asia Bearish, western world modestly bullish.

Catalysts: Jobless Claims, Philly Fed MFG Index, Housing Starts & Import Prices @ 8:30.

Quick Tip: Try Waiting

Successful trading skills are very different in many cases than how we’ve been conditioned to believe and behave.

We all were taught winning and being right were good, losing and being wrong were bad. These concepts don’t apply to a probabilities game like trading.

Here’s another example via some advice from arguably one of the best traders in history, Jim Rogers.

Jim Rogers quote: “I just wait until there is money lying in the corner, and all I must do is go over there and pick it up. I do nothing ...

Trade Aptitude

Results of Tuesday’s Best S&P Turning Points: Neither suggested trade triggered and remain on the chart.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Buy 3833.00 stop 3827.75. Short 3999.00 stop 4004.75.

The World Sentiment Index: (+100/-100) drops from -29 to -43 with Asia neutral/positive and the western world very Bearish on high volatility.

Catalysts: PPI, Retail Sales & Empire State MFG Index @ 8:30. Housing Market Index @ 10:00. Crude Oil Inventories @ 10:30. Risk off.

Quick Tip: Winning Streaks

It seems like we spend plenty of time discussing how to handle losing streaks and drawdowns. What about winning streaks?

Our intraday trend strategy is up 118.75 S&P points in the past two days with 10 winners and 3 losers. If you traded the Globex last night you banked another 71 points on a single trade.

Winning streaks can be a double-edged sword. On one hand, they can boost confidence and motivation, but on the other hand, t...

Trade Aptitude

Results of Monday’s Best S&P Turning Points: Buying 3864.50 stopped out in the pre-market.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Buy 3833.00 stop 3827.75. Short 3999.00 stop 4004.75.

The World Sentiment Index: (+100/-100) increases from -57 to -29 in a world of mixed sentiment.

Catalysts: CPI @ 8:30. Eyes on financials.

Quick Tip: A Different View

You’ve probably heard the phrase “trading is simple, it’s just not easy.” Indeed, trade plans can be simple to execute but because of our thoughts, emotions, and behaviors we make it hard to follow thus missing the result we want.

Let’s say your “simple” trade rules were based on 1) Determine the big picture trend, 2) Sell rallies in a downtrend on a shorter time interval, 3) Buy dips in an uptrend on a shorter time interval. This is not only simple, but it makes sense. Price moves in waves of impulses and corrections within a trend.

It turns out that your results can also m...

Trade Aptitude

Results of Friday’s Best S&P Turning Points: Buying 3892.50 stopped out. The breakout short from there ran for only 9.75 points.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Buy 3864.50 stop 3860.50. Short 3999.00 stop 4004.75.

The World Sentiment Index: (+100/-100) EASES from -86 to -57 with most major world markets very bearish on higher volatility. S&P Futures are currently bucking that trend near flat. Historically the close was lower than the open 73% of the time.

Catalysts: Nothing on the economic calendar. SVB & Signature Bank depositors saved but who’s next? CPI tomorrow.

Quick Tip: Why Day Trading?

Whenever I tell someone I’m a day trader they usually react with a blank stare and say something like “That’s very risky, isn’t it?” Then I’ll say that regardless of your time horizon, you need to have a solid risk management plan in place.

It usually ends there. Occasionally, they’ll keep asking questions digging deeper f...

Trade Aptitude

Results of Thursday’s Best S&P Turning Points: Shorting 4012.75 ran for 64 points to the buy at 3948.75 which bounced and ran for 10 points. Read the Quick Tip for a discussion on the short.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Buy 3892.50 stop 3887.50. Short 3999.00 stop 4004.75.

The World Sentiment Index: (+100/-100) DUMPS from -36 to -86 with all major world markets very bearish on higher volatility. S&P Futures are currently bucking that trend near flat. Historically the close was higher than the open 58% of the time.

Catalysts: Employment Report @ 8:30. Treasury Statement @ 14:00. Banking sector plummets on SVB scare, concerns abound on a bigger problem.

Quick Tip: Fine Tuning

Yesterday’s short volume level was a tricky trade to report. If you followed the suggested stop you stopped out, only to see the trade run 64 points. If you gave it some extra room, as is suggested for faster markets, you sold the top then cau...

Trade Aptitude

Results of Wednesday’s Best S&P Turning Points: Buying 3976.00 ran for 27.25 points on day with a range of 31.75! Tips accepted via CashApp.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Buy 3948.75 stop 3943.00. Short 4012.75 stop 4018.50.

The World Sentiment Index: (+100/-100) DUMPS from zero to -36 in a mostly Bearish world of low volatility. Historically the close was higher then the open 55% of the time and 1.5X the size of down moves.

Catalysts: Jobless Claims @ 8:30. Tomorrow’s Jobs data will be a bigger catalyst.

Quick Tip: Your Report Card

Since we’re in a “numbers business” as traders it makes sense to assess our performance objectively for every trade, not just how much the account is growing.

Most traders will think that a losing trade was a bad trade. Not so. The losers are inevitable and are out of our control if we’re following our plan. A bad trade is actually one where you broke the rules, win or lose. Good t...

Trade Aptitude

Results of Tuesday’s Best S&P Turning Points: Buying 4019.25 was cancelled during Powell’s testimony (stopped out).

Today’s Best S&P Turning Points (trades are cancelled during Powell’s testimony if volatility is high):

Buy 3976.00 stop 3971.75. Short 4012.75 stop 4018.50.

The World Sentiment Index: (+100/-100) DIPS from +14 to zero in a world of mixed sentiment and mostly low volatility. Historically it’s a coin toss which way price will close.

Catalysts: ADP Payrolls @ 8:15. International Trade @ 8:30. JOLTS & Powell Testifies @ 10:00. EIA Petroleum Status @ 10:30. Max interest of 6% is on the table. Recession more likely.

Quick Tip: Goodbye Dementia

If you’re a Boomer or X-Gen you probably have been paying attention to the progress being made on solving/delaying dementia & Alzheimer’s as we age.

Setting drug research aside, the best thing you can do is to engage in complex, mentally stimulating cognitive activities. Studies have shown that this lowers risk of developing ...

Trade Aptitude

Results of Monday’s Best S&P Turning Points: Shorting 4066.00 offered an 8-point move. The breakout afterward offered 12.50 points.

Today’s Best S&P Turning Points (trades are cancelled during Powell’s testimony if volatility is high):

Buy 4019.25 stop 4015.25. Short 4103.75 stop 4109.50.

The World Sentiment Index: (+100/-100) REMAINS at +14 in a world of mixed sentiment and low volatility. Historically price closed above the open 56% of the time with 2X the gain versus loss.

Catalysts: Powell Testifies @ 10:00. Expect extra volatility after the prepared statement during the Q&A.

Quick Tip: Breakouts

You’ve no doubt heard “old resistance becomes new support” as price passes through a chart pattern. The same applies to the volume-at-price levels shared in this blog.

The chart above shows the entries for reversal and breakout clearly. What isn’t clear at all is when you took profit on the initial short. An 8-point move is not huge, but enough to start scaling out and/or movin...

Trade Aptitude

Results of Friday’s Best S&P Turning Points: Shorting 4050.25 offered a 7-point move before closing the session around breakeven.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Buy 4019.25 stop 4015.25. Short 4066.00 stop 4070.75.

The World Sentiment Index: (+100/-100) DROPS from +64 to +14 in a world of mixed sentiment and low volatility. Historically price closed above the open 56% of the time with 2X the gain versus loss.

Catalysts: Maybe Factory Orders @ 10:00. Waiting on Powell’s testimony on Tuesday/Wednesday. Holding cash at the current T-Bill rate of 4.74% is growing very popular.

Quick Tip: Know Your Opponent

Trading is a battle. Bulls vs. Bears. Considering what other traders are doing and why when you’re entering or exiting a trade is good thinking.

You’re following a rule-based trade plan so you know when you get a signal why you’re entering. You simply have edge, not a fool-proof trade. This means there will be ti...