Trade Aptitude

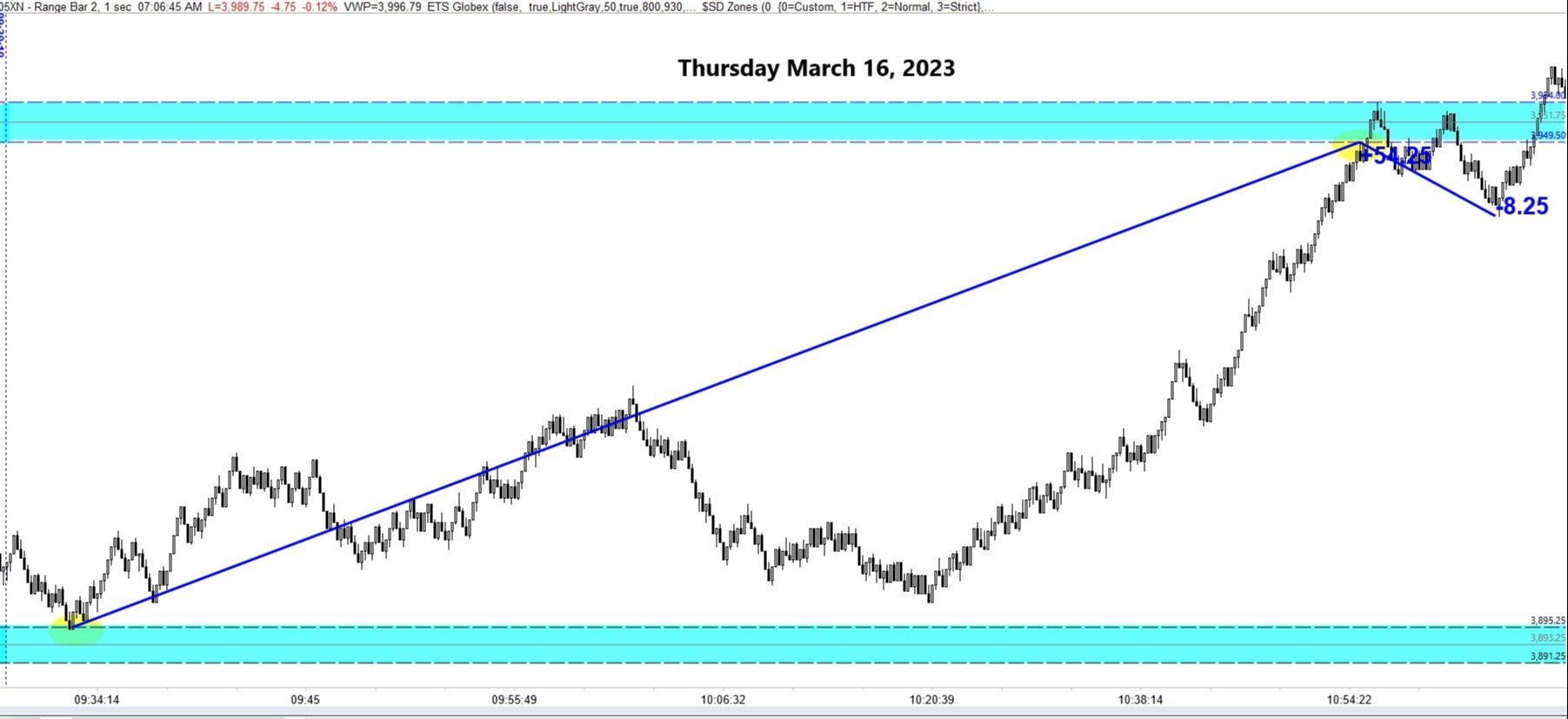

Results of Thursday’s Best S&P Turning Points: Buying 3895.25 picked the bottom of the session and ran for 54.25 points to the suggested short @ 3949.50, which only offered an 8.25-point reversal. Feel better about the win by donating a slice to my preferred charity, the Alzheimer’s Association. Click here.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Buy 3913.50 stop 3908.25. Short 4073.50 stop 4077.50.

The World Sentiment Index: (+100/-100) SOARS from -14 to +50 with all major world markets bullish while the S&P futures are lagging. Historically the market closed lower than the open 58% of the time.

Catalysts: Industrial Production @ 9:15. Consumer Sentiment (including preliminary Inflation) @ 10:00. Co-opetition among big banks suggests the banking problem isn’t over. Fed chips in, too.

Quick Tip: Getting Lucky

Happy St. Patrick’s Day! The perfect time to discuss luck in trading. Does it exist? Of course. From a mathematics viewpoint, luck is simply an unexpected event. Good or bad in your eyes, they’re still unexpected events.

You should be following a trade plan that has edge. You’re finding your edge using statistical analysis to calculate the probabilities of wins and losses. Best if your research considers different market conditions. This is your attempt to find some “good luck.”

You also need a risk management plan that minimizes the effects of luck. Done properly you can limit your exposure to “bad luck” and increase the likelihood of success over the long term.

Lastly you should stay disciplined to your plan rather than randomly relying on gut instincts or emotions. If you base your decisions on objective data and analysis, you’ll reduce the impact of luck on your results.

Our team day-trades multiple strategies with edge in a live online environment. We rely on the results of thousands of documented trades to help us keep the edge in real time. Join our team, learn the strategies, and trade live with us daily for 30 days. Money back if you’re not blown away!

Trade Fearlessly,

Mike Siewruk