"How to learn anything faster and better."

I thought I understood how to learn my whole life. Then I found Pomodoro. It's been a game-changer for my trading AND my life. Invest 11 minutes in this video. You will be blown away at the results you'll get.

Why Trade Futures?

What are Futures?

For comparison sake, let’s start with a market you’re already familiar with… the stock market. When you buy a stock, say Apple, you’re getting a share of ownership in the company. Your share gives you a slice of the profits, called a dividend, and the right to vote that share on key company issues.

Of course, unless you own a huge number of shares your vote is not so important. Thus, the primary goal of most shareholders is appreciation. You want the share price to rise. That’s how you really make money in stocks. Buy Apple for $150 a share and sell it for $300 a share. That’s a 100% return. Nice.

Except… stock prices go up and down, sometimes in a very volatile way. That’s where timing comes in. If you’re disciplined enough to buy at a low price and skilled enough to sell at a higher price you’re doing well. Easier said than done, but that’s why you’re reading this.

Now here’s something you may not know about the stock market. You can make money if the stock price goes down. That’s called short selling.

Here’s how it works: you think Apple is going down so you borrow shares from your broker, sell them instantly, and repay the loan later by buying back the shares at a lower price (keeping the difference).

Of course, if Apple goes up while you're short and you have to buy them back at a higher price, you’ll lose money.

But that’s really no different than buying Apple expecting it to go up and selling it after it went down.

Either way, loss is certainly possible. But don’t worry about that right now, you’re going to learn how to manage the risk either way, long or short, so you won’t get hurt.

As traders we want to make money regardless of direction. You now know you can do that in the stock market and you can also do that in the Futures market.

In fact, the Futures market couldn’t even exist if there was no short selling.

Here’s why: When you buy in the Futures market you’re not owning a share of anything, you’re entering into a contract. And since all contracts must have two parties, that means someone had to be the counter-party of your contract… creating a “trade.” Two opposing viewpoints on price direction.

The most popular Futures contract related to the stock market is called the S&P 500 Index. Simply put, the cash index is a basket of the 500 largest public companies and represents about 80% of the value of the entire stock market. The Futures contract mimics the moves of the cash index allowing us to “trade” the index.

If you thought the stock market was going up you would open your trade by BUYING a contract on the S&P 500. If the market goes up, the value of that contract goes up allowing you to sell the contract at the higher price and keep the difference.

Conversely, if you thought the market was going down you would open your trade by SELLING a contract on the S&P 500. If the market goes down the value of the contract goes down and you would buy it back at a lower price and keep the difference.

Here’s an example that should clear up key questions you’re likely to have:

Let’s say you enter into a contract to buy a house and the closing is set for 60 days from now.

The main components of that contract are the house (which must be in the same condition as when you contracted), the price (agreed upon now and fixed on the closing day), a good faith deposit on your part (say $10,000), and a future closing date which would be when you pay the balance and take ownership (delivery).

Those are also the main components of all Futures contracts; asset description, price, deposit, settlement date, balance due.

Let’s say the house you put under contract soared in value during that 60-day period between contracting and closing and you knew someone who wanted the house more than you did. They were willing to buy your contract from you at a $10,000 profit to you. That would be a 100% return on your good faith deposit. In 60 days. Great trade! Of course, this rarely happens in the housing market but does happen every second of every trading day in the Futures market.

As traders, when we buy a Futures contract we have no intention of waiting until the delivery date and actually completing the contract and owning the asset. We are simply speculating that the price of the asset will rise and we will quickly sell the contract at a higher price then we paid to bank a profit.

When we sell a Futures contract we have no intention of waiting until the delivery date and providing the buyer the asset. We simply believe the price of the asset will drop and we will quickly buy the contract back at a lower price than we sold it for to bank a profit.

You might be thinking at this point, “what if I can’t sell my contract or buy it back?” No worries. The Futures market for the S&P 500 is the most popular worldwide. There are around 2 million contracts traded every day, which means there is always a seller or buyer for your contract, unlike the house example.

You might also be thinking, “what if I’m the buyer at time of delivery, am I obligated to buy?” Legally, yes. But again, no worries. We are not long-term traders in Futures contracts. In fact, your trades in the Futures market are usually completed the same day, in and out, buy and sell. Profit or loss. No obligations.

Benefits of Futures Trading

- Get started with modest capital

The best use for the futures market is for generating short-term income. To do that in the stock market requires significant capital.

In fact, your broker will require you to maintain a minimum equity balance in your trading account of $25,000 to earn pattern day trading status. If your equity drops a penny below that amount, your account will be frozen until you add capital. For that reason, most brokers will require you to start your day trading account with $30,000 giving yourself some wiggle room to absorb losses.

There is no such rule in the Futures market. Minimum deposits vary by broker but $5000 is not an uncommon starting point.

- Superior leverage

If you qualify for pattern day trading status in your stock brokerage account you will receive increased leverage of 4:1 for day trading (i.e., in and out during open market hours).

So, your $30,000 account allows you to day trade $120,000 worth of stock, interest-free for the day. That’s a nice benefit but not nearly as attractive as the futures market.

Futures offer far more leverage than 4:1 allowing us to trade with far less capital. Every Futures broker sets their own leverage amounts for each contract by adjusting what is called the margin deposit. Think of the margin deposit as a down payment. It’s the amount you are setting aside in your account to take the trade.

Whether you’re a buyer or a seller, you must have the proper margin deposit and that amount cannot be used for any other purpose while your trade is open.

Closing the trade frees up the margin deposit immediately for use in your next trade. This instant settlement allows us to better use the capital in our account by taking frequent trades within one day.

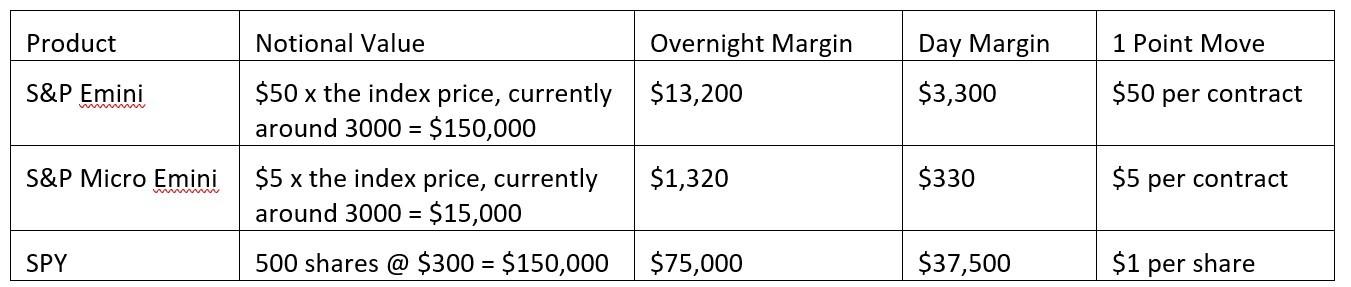

Using the S&P 500 Index as our example, the following table shows the key differences of trading in the stock versus the Futures market. The Futures contract is called the S&P Emini or S&P Micro Emini. The “stock” you would use is actually an Exchange Traded Fund (ETF) called SPY.

The first thing you should notice is the leverage is far better in Futures.

If the index is at $3000 then SPY will be at $300 a share. One S&P Emini contract would be worth $150,000 ($50 X the Index) so you would need to buy 500 shares of SPY to equal the notional value of the futures contract.

Since day-trading leverage is 4:1 your broker would require you to set aside $37,500 (25%) to enter the trade. In the futures market, you’ll be setting aside only $3,300. That’s a massive difference in your favor!

OK, so we’re happier having less “down payment” but here is the real kicker. If SPY increases by $1, your 500 shares will give you a profit of $500, which is 1.3% on your investment of $37,500. That $1 move in SPY is equal to a $10 move in the futures contract. You’ll make the same $500 profit, but now earn 15% of your investment of $3,300! Another massive difference in your favor!

The second thing you should notice is there are two different contracts for trading the S&P 500. The Emini and the Micro Emini. The difference is simply size. The Emini moves at $50 for every $1 move in the index, the Micro moves at $5 for every $1 move in the index. Simply put it is 1/10 the size. That means 1/10 the margin deposit, 1/10 the gains, and most importantly 1/10 the risk.

With the Micro contracts, which were introduced in May 2019, everyone can afford to trade in the futures market and enjoy all the benefits.

- Trade day or night with minimal time commitment

The stock market is open from EST 9:30 am to 4:00 pm. If you work during those hours day trading stocks is very difficult, if not impossible.

The Futures markets are open all night for access to worldwide traders. Plus, one trading strategy (of several) you'll learn from The Daily Market Forecast Team does not require you to be watching your computer screen while you trade.

We plan ahead, enter our orders in our broker-provided trading platform, and go about life (work, play, even sleep).

If you want to adjust any active trade it can be done from the app on your cell phone… from wherever you are.

Specifically, the S&P 500 Futures “open” for trading every day at 6 pm ET. They will trade continuously until 4:15 pm the next day when they’ll close for 15 minutes, re-open for 30 minutes and then stay closed from 5 pm to 6 pm (the next open).

The time from 6 pm to 9:30 am the next day when the stock market opens is called the Globex session. The time from 9:30 am to 4:15 pm is called the Day or Cash Market session. These two sessions trade differently, in a good way.

To give you an idea about your time commitment for day trading Futures, consider this. If you’re a member of The Daily Market Forecast Team you will receive two trading plans every market day.

The Morning edition, available by email or download at 8 am ET, will guide you to the best trade setups (entries, exits, risk management) for the Day session.

The Globex edition, available by email and download at 5:30 pm, will guide you to the best trade setups for the coming evening.

Once you’re trained on using the strategy, it should take you 10 to 20 minutes to enter your orders for the coming session. That’s it.

We also day-trade three different strategies live in our daily Zoom sessions. These require attention during the open trade.

Most traders enjoy working in a community format. It’s proven to be better than going it alone. Even Wall Street firms still have centralized “trading desks” though the traders could be doing their job from home. Why? Synergy. Sharing. Simply put, you will learn and improve faster and better on a team of skilled traders.

To mimic their success, as a member of The Daily Market Forecast Team you’ll have access to our daily Live Trading Zoom sessions every Monday through Friday starting at 9 am ET.

In these 2-hour sessions we will review the results from the prior session and plan our trades for the next session.

We will also use these sessions to answer your questions, and teach you about trade strategy, risk management, position sizing, trend analysis, volume analysis, volatility adjustments, and psychology.

If you’re unable to attend live during those times, you can access each daily Zoom session via recording.

- Less Risk than Stocks

While having a solid trading strategy (rule set) with an edge in your favor is essential, the two most critical traits of a great trader are owning the skills of risk management and personal psychology.

Let’s explore risk management first. Every trade setup you receive will include a “stop loss order.” This is simply a pre-planned amount of money you are prepared to lose if the trade setup fails. It should be an amount of money you can lose without any financial hardship or negative emotional reaction.

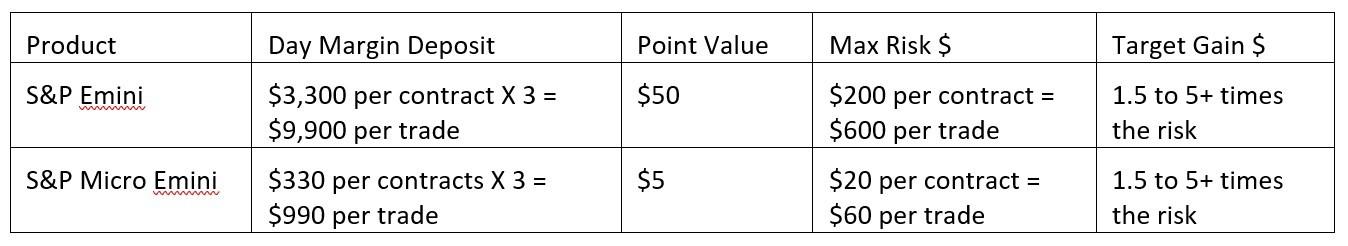

The good news is the S&P 500 Futures have two contract sizes, as you now know. The trading strategies you’ll learn and execute will trade a minimum of 3 contracts. The risk per contract never exceeds 6 points of movement.

Here's a table to illustrate the difference between the two contracts and how you can decide for yourself, in advance, what amount is an acceptable loss for your personal circumstances.

As you’ll recall, the Emini is 10x the size of the Micro Emini. There is a huge difference in the risk and reward profile of the two contracts, as you can see above. The good news is that we get tremendous flexibility by adjusting the quantity and/or combining the two contracts. We can define any risk number (from $60 and higher for our strategy) to target the income we desire. You’ll learn all the nuances of doing this in your daily Zoom sessions.

The other important benefit to risk management in the Futures market over the stock market is this: stocks close at EST 4:00. If you’re holding a position overnight your stop loss orders are not active. This means you could see that stock plummet at the open the next day due to bad news leaving you with a major, unintended loss.

Since Futures are open all night, your stop loss order is active and you’ll only lose what or near you intended.

- The Power of Psychology

Trading is different than working. We need to acknowledge and manage the differences and that’s where our personal psychology comes into play. Workers receive an agreed upon paycheck for their labor. We can count on it every month.

Trading doesn’t offer any such promise. We can do a superb job of managing our trading and end up with no paycheck or even lose money (i.e., writing a paycheck to the market). In our daily Live Zoom sessions we'll explore the psychology of trading in detail.

The key to trading success is how we manage our reaction to two events: winning and losing. Being too excited about wins and too despondent about losses will ruin your chance of success. The very best way to resolve this problem is start your trading with very small position size. That means very small losses.

The good news about the S&P Futures is that we can start trading Micro Eminis risking as little as $60 per trade. Granted, you probably won’t meet your income goals with such a small risk because the reward in trading is related to the risk. More risk generally allows for more profit, dollar-wise.

But that’s OK because once you learn consistency, your confidence in increasing your risk, hence reward, will be strong. The surest way to fail at trading is focusing too much on profit. Focus instead on losing an acceptable amount (very personal), get consistent, then raise your risk… slowly.

If you do anything else, you will likely run into a losing streak and quit. The old saying applies: Winners never quit and quitters never win. Don’t quit. And you can do that by keeping losses very small as a beginner.

Here’s where trading in a community is a major benefit. In our daily Zoom sessions you’ll be trading with some very experienced traders. You’ll find answers to your questions and the courage and confidence to place your trades. I’ve been trading since 1999 and still prefer a community to being a lone wolf. It’s incredibly helpful.

- Tax Advantages of Futures

When I was teaching live classes I would always ask the students this question: “Would you vote for a flat 21% tax, social security and Medicare included?” Obviously, plenty of people pay more than that and would vote it in tomorrow! Well, you don’t have to write to your congressperson. That tax plan is available today.

Here’s how it works: First off, the income from trading is considered “capital gains” which means there is no social security or Medicare tax on those gains.

Second, the IRS taxes Futures gains LESS than gains on stocks. Specifically, they fall under a 60/40 rule which allows us to pay the long-term capital gains rate on 60% of our Futures trading profits and the short term rate (equal to our ordinary income rate) on 40% of our Futures trading profits, regardless of how long we held the trade open.

Here are some scenarios:

- Your ordinary tax rate is 25% and you had $30,000 in Futures trading profits for the year. 60% of $30,000 is $18,000. The long-term capital gains tax on that is ZERO. 40% of $30,000 is $12,000 so the ordinary rate tax would be $3000 . That’s a blended tax of only 10%. Trading stocks the tax would have been $7500 or more than twice as much!

- Your ordinary tax rate is 30% and you had $100,000 in Futures trading profits for the year. 60% of $100,000 is $60,000. The long-term capital gains tax on that is 15% or $9000. 40% of $100,000 is $40,000 so the ordinary rate tax would be 30% or $12,000, the combined tax is $21,000 (21%). Trading stocks the tax would have been $30,000 (30%) or 43% more!

You can eliminate or defer ALL the taxes by using an IRA. Most Futures brokers allow Traditional and Roth IRAs for Futures trading.

Gains in your Traditional Futures IRA are deferred. Gains in your Roth IRA are non-taxable (after a several-year holding period).

Now that you’ve been introduced to trading Futures and understand all the incredible benefits this market offers, it’s time get more advanced lessons. Click here to learn all the benefits of Team Trading using our Get PAID! methodology.