Trade Aptitude

Results of Friday’s Best S&P Futures Turning Points: : Neither trade triggered.

Today’s Best S&P Futures Turning Points (consider wider stops and less size in fast moving markets):

Buy 4769.00 stop 4765.25. Short 4800.50 stop 4805.50 (Buy the breakout if this short fails).

The World Index: (+100/-100) reverses from +29 to -21 with most major world markets mildly Bearish. S&P futures are not.

Catalysts: NAHB Housing Market Index @ 10:00.

Quick Tip: Consistency

Here’s an important quote from Dr. Brett Steenbarger, author of many books on trader psychology and an accomplished S&P futures day trader:

“You are most likely to become consistent IN your trading if you are consistent in working ON your trading.”

How? Preparation and review. Sports teams do this. Prepare for the opponent, play the game, watch the video reviews.

Are you preparing...

Trade Aptitude

Results of Monday’s Best S&P Futures Turning Points: : No levels offered due to contract rollover.

Today’s Best S&P Futures Turning Points (all trades are filtered out prior to CPI release today):

Buy 4662.00 stop 4658.25. Short 4714.50 stop 4719.75.

The World Index: (+100/-100) gains from +14 to +29 with most major world markets mildly Bullish.

Catalysts: CPI @ 8:30. 30-year bond auction @ 13:01.

Quick Tip: Commitment

If you’re relatively new to trading you’ve probably experienced overwhelm from all the choices you have. All the decisions you must make.

What asset to trade?

Which timeframe?

Which broker?

Whose strategy to follow?

How much to risk?

The list is long. After guiding more than 4000 new traders through the process of making these decisions over the past 15 years I’ve found there is a hierarchy to these decisions.

Start with commitment....

Trade Aptitude

Results of Friday’s Best S&P Futures Turning Points: Buying 4572.50 was filtered out during the Employment Report @ 8:30.

Today’s Best S&P Futures Turning Points (consider wider stops and less size in fast moving markets):

The volume levels are affected by rollover today and are filtered out.

The World Index: (+100/-100) gains from +7 to +14 in a world of mixed sentiment.

Catalysts: 10-year bond auction @ 13:01.

Quick Tip: Futures Rollover

Futures contracts are buy/sell agreements between two parties. Every contract has a delivery date at which point the transaction ends and goods/money are exchanged.

Many futures traders have no intention of fulfilling their contractual obligations. They’re either speculating on price direction or hedging against price changes. For these traders exiting the current contract before the delivery date and entering the next contract further out on the calendar is...

Trade Aptitude

|

Trade Aptitude

Results of Thursday’s Best S&P Futures Turning Points: Buying 4551.00 was only good for a 4-point scalp. The breakout short failed.

Today’s Best S&P Futures Turning Points (consider wider stops and less size in fast moving markets):

Buy 4557.50 stop 4551.75. Short 4598.50 stop 4604.25.

The World Index: (+100/-100) falls from +50 to -14 in a world of mixed sentiment.

Catalysts: Final MFG PMI @ 9:45. ISM MFG PMI & Prices @ 10:00. Fed’s Goolsbee @ 10:00, Powell @ 11:00 and 14:00.

Quick Tip: Measured Moves

Price tends to move in impulses and corrections. The impulse is the primary direction of the trend. The correction is the minor countertrend move.

Get in the habit of looking to the left on your trading chart and measuring these impulses and corrections. Frequently you’ll see patterns that repeat.

For example, an 8-point move higher, followed by a 3-point move lower, then...

Trade Aptitude

Results of Tuesday’s Best S&P Futures Turning Points: The short at 4598.50 missed filling by 6 ticks.

Today’s Best S&P Futures Turning Points (consider wider stops and less size in fast moving markets):

Buy 4551.00 stop 4546.25. Short 4598.50 stop 4604.25.

The World Index: (+100/-100) jumps from -14 to +50 with all major world markets Bullish.

Catalysts: Core PCE Price Index (primary Fed inflation measure), Jobless Claims & Personal Income/Spending @ 8:30. FOMC Williams @ 9:15. Chicago PMI @ 9:45. Pending Home Sales @ 10:00. OPEC meeting all day.

Quick Tip: Find Your Filters

Are there market conditions that your strategy performs better or worse in? Probably so. Price is either trending or not and volatile or not. These are very different conditions and knowing with evidence how your strategy performs in each of them is important.

Why? Because you’ll be able to...

Trade Aptitude

Results of Monday’s Best S&P Futures Turning Points: Buying 4551 filled in the Globex session early this morning running for 9.50 points so far, still open.

Today’s Best S&P Futures Turning Points (consider wider stops and less size in fast moving markets):

Buy 4521.00 stop 4517.00. Short 4598.50 stop 4604.25.

The World Index: (+100/-100) rises from -43 to -29 with most major world markets mildly Bearish.

Catalysts: Home Price Index @ 9:00. Consumer Confidence, Richmond MFG Index, and Fed’s Goolsbee @ 10:00. More Fed speakers @ 10:05, 10:45, 13:05, and 15:30.

Quick Tip: Mastering Trading

George Leonard noted in his book Mastery that “Our culture has become hooked on the quick fix, the life hack, efficiency. Everyone is on the hunt for that simple action algorithm that nets maximum profit with the least amount of effort.”

Sounds like “Lottery Mentality.” And...

Trade Aptitude

Results of Thursday’s Best S&P Futures Turning Points: Neither trade triggered.

Today’s Best S&P Futures Turning Points (consider wider stops and less size in fast moving markets):

Buy 4517.00 stop 4511.25. Short 4598.50 stop 4604.25.

The World Index: (+100/-100) rises from -36 to +14 with China/HK Bearish and the west mildly Bullish.

Catalysts: Building Permits & Housing Starts @ 8:30. Fed’s Goolsbee @ 9:45.

Quick Tip: Flexcasting

Forecasting is tough. You can find and analyze all the available evidence and still get it totally wrong. That’s where flexibility comes in. Hence the word “Flexcasting.”

Here’s an example:

1. Historically the S&P trends long the best on Fridays. Maybe it’s due to short covering before the weekend. Maybe it’s just the high spirits going into two days off. It doesn’t matter. The evidence is there.

2. There are...

Trade Aptitude

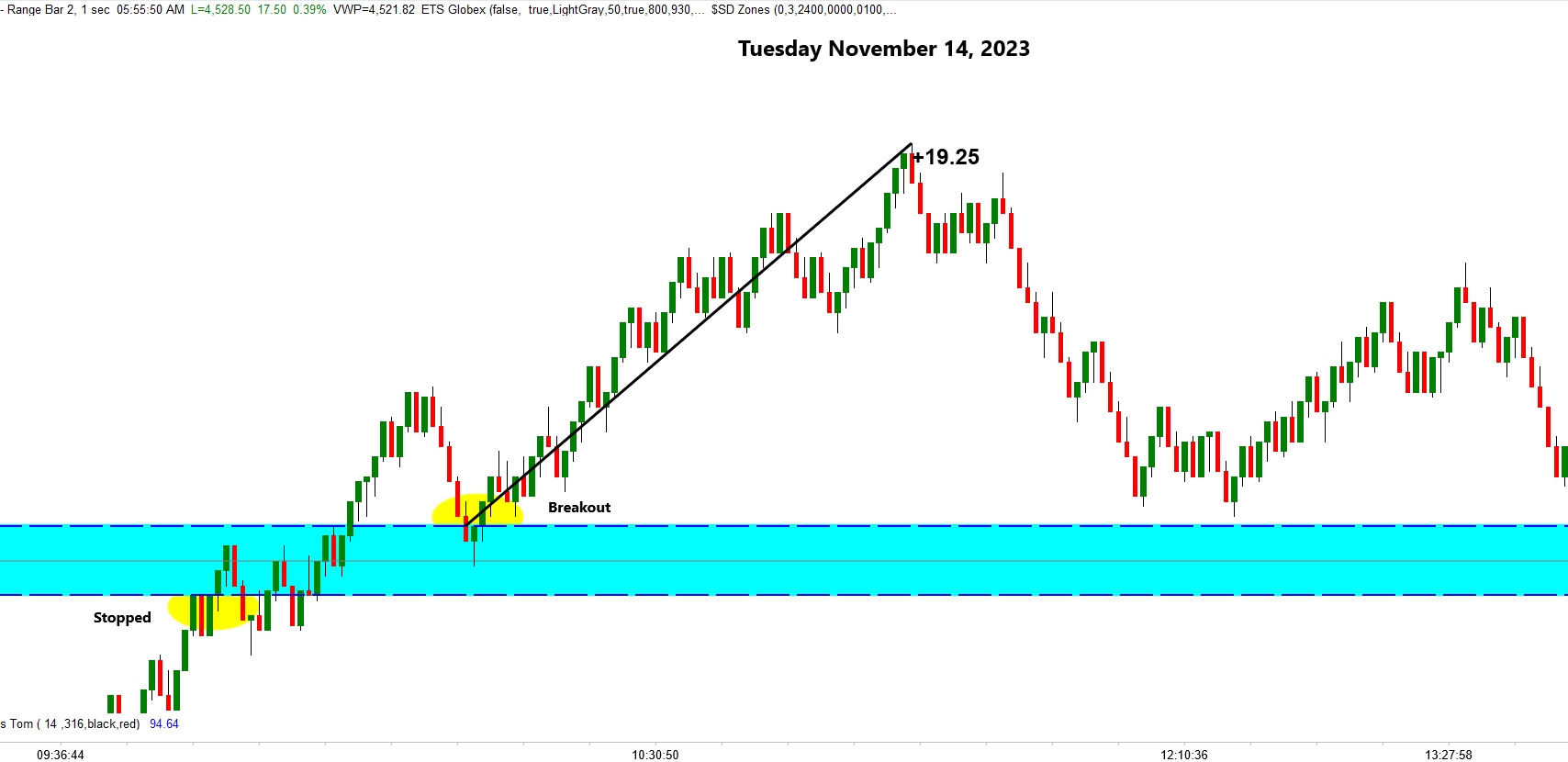

Results of Tuesday’s Best S&P Futures Turning Points: The short at 4498.00 stopped out. The breakout ran for 19.25 points.

Today’s Best S&P Futures Turning Points (consider wider stops and less size in fast moving markets):

Buy 4430.00 stop 4425.75. Short 4598.50 stop 4604.25.

The World Index: (+100/-100) soars from +7 to +64 with all major world markets solidly Bullish.

Catalysts: PPI, Retail Sales & Empire State MFG Index @ 8:30. Fed’s Barr @ 9:30. Crude Oil Inventories @ 10:30.

Quick Tip: Parabolic Moves

Yesterday was as fun as trading can be if you were long. Day, swing, or position trades all printed green.

For day trades you’re ready for a continuation or a reversal today. No worries. But for swing and position trades you have a tough decision to make.

The S&P is in a near parabolic move up. These simply don’t last forever, sometimes not for long at...

Trade Aptitude

Results of Monday’s Best S&P Futures Turning Points: There was a typo on the short yesterday, well below price. The long didn’t trigger.

Today’s Best S&P Futures Turning Points (consider wider stops and less size in fast moving markets):

Buy 4364.75 stop 4360.75. Short 4498.00 stop 4502.25.

The World Index: (+100/-100) drops from +21 to +7 in a world of continuing mixed sentiment and low volatility.

Catalysts: CPI (watch Core) @ 8:30. Fed’s Barr @ 10:00. Fed’s Goolsbee @ 12:45.

Quick Tip: Big Picture

What’s your Big Picture? The correct answer depends on your time horizon (intended holding period) and trading chart time interval.

If you’re a day trader using a 5 or 10-minute chart, you’d be out by the end of the day and watching the behavior of the 30 or 60-minute chart.

If you’re a swing trader using a 60-minute chart, you’d be out in...