The Daily Market Forecast... recycle this indicator

Today’s Lesson: A new use for ATR

Welles Wilder was mentioned yesterday when explaining a use for his Parabolic SAR. Possibly his most famous indicator is ATR (Average True Range). The word “true” in the name refers to the fact that this includes gaps in the calculation. Average Range would not.

There are numerous ways to use ATR in your trading. One common way is to position your stop loss as a multiple of ATR, expecting that price won’t go there (anytime soon). Likewise, you can use it for profit targets.

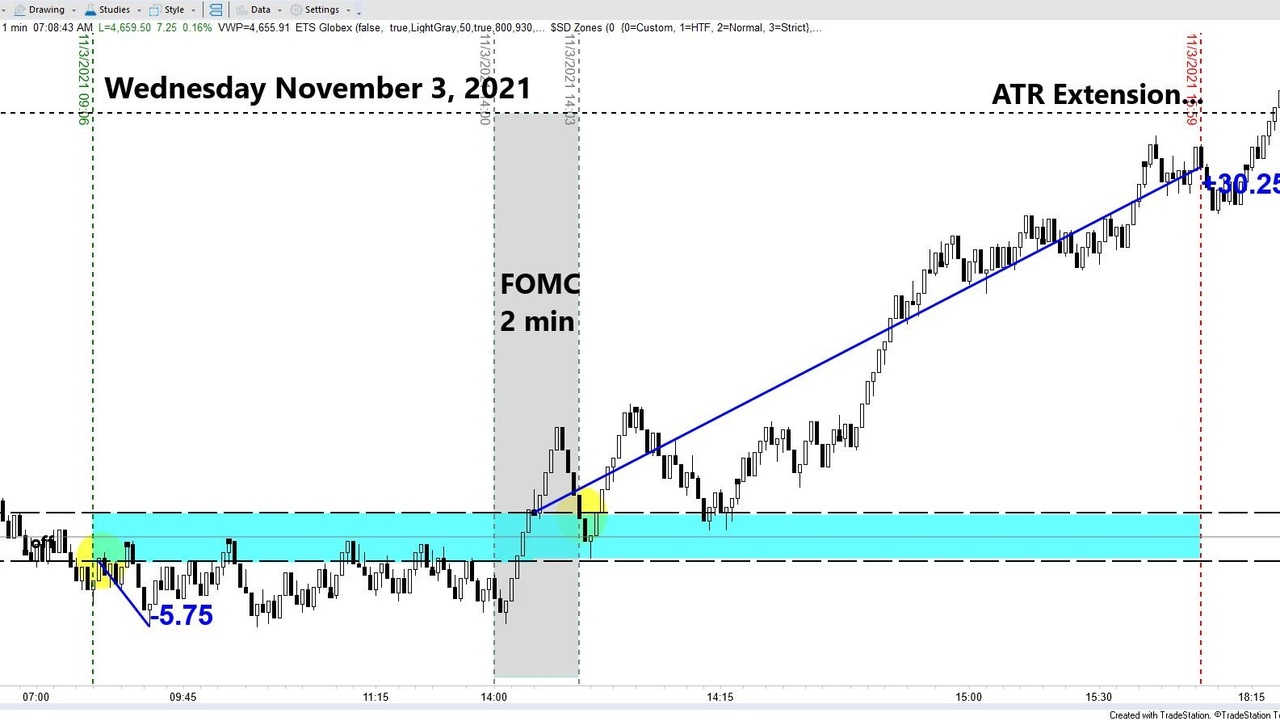

One way I’ve found that can be uncannily accurate is ATR Extension. Looking at the chart above you’ll see a dotted line near the top. This was the ATR added to the prior day’s close. There is another (unseen on the chart) line for ATR subtracted from the prior day’s close.

These ATR extensions act like magnets when price runs far. They can be stalls, reversals or simply profit targets. Think about it, price has made an extended move and could be getting tired. As with all techni...

The Daily Market Forecast... Lesson Day

Today’s Lesson: Trail Stopping

The idea of moving your stop loss automatically so it follows or “trails” price moving in your direction is alluring. The main deficit is that price can be “noisy” moving in choppy impulses and corrections that trigger the stop. You’ll miss plenty of great moves.

On the contrary, you don’t want to leave your stop the same after price has moved well in your favor but not to your profit target yet. Watching a winning trade lose is painful and unnecessary.

There are several ways to place a trailing stop. The first decision you must make is whether you want to manually adjust it or not. For automatic trailing stops any decent trading platform will allow you to enter the stop by points/dollars or percentage. If your initial stop is 4 points away, let that be the trailing stop. Easy enough.

If you’re willing to manually move the stop there are chart patterns and indicators that can smooth out the noise of the price move. Price pivots and moving averages are...

The Daily Market Forecast... confluence

Today’s Lesson: Power in confluence.

You have a trade plan with specific rules of entry and exit that produce a positive expectation (if not, get one or quit trading). If EVERY trader used the same plan and followed it precisely there would be no one to trade against.

You WANT and NEED traders to do something different than you. This is a good thing. Now if you want to step up your performance you’ll learn OTHER popular trading strategies. Not necessarily to trade them, but to consider what OTHERS may be doing at the same time.

Here's a simple example: the 20-period moving average is a popular technical indicator. You may not use it because it is a lagging indicator or you haven’t been taught HOW to make it work. Regardless, there are traders who use it. Put it on your chart.

Why? Because if your strategy is getting a signal to enter around there you might be finding some confluence (with other trade plans). If you’re short in the trade and wondering about a good profit target, app...

The Daily Market Forecast... think global

Today’s Lesson: Think global.

Successful investors and traders alike have a rule-based strategy that provides them a financial advantage or “edge.” A combination of fundamental and technical analysis are typical components. Another analysis you can add to the recipe is investor “mood” commonly called sentiment. In other words, do market participants feel bullish, bearish or neutral about the future?

While every region and country has a unique economy, given the volume of international trade those individual economies are part of a larger “global” economy. The U.S. economy is the largest in the world but more importantly for us it is also the last market traded on the daily clock. This allows U.S. traders a glimpse at how the Asian and European markets are trading before our stock market opens.

Many years ago, I developed a simple indicator for world sentiment, which I call the World Index. The foundation of which is the daily cash market percentage change of the major Asian and Euro...

The Daily Market Forecast... Trade at night

Today’s Lesson: Trade at night.

With 23-hour futures markets for the most liquid contracts, anyone can find time around their work schedule to trade. Our research (and experience) shows repeatedly that trading the S&P futures from 6 PM ET until the cash market open at 9:30 AM ET is better than the day session.

Here's a trade from last night to analyze (see chart).

- Price opened within the day’s high-volume level.

- Trading below signals a short entry.

- Ultimate profit target would be the next volume level @ 44.25

- Prior day low is a typical stall/bounce price, chose to exit there.

OK, that’s all easy enough. My point in sharing this is twofold:

First, while I entered the trade at 6:04 PM ET, the final exit occurred at 3:08 AM ET while I was sleeping. Now THAT is effective use of your time!

Second, if you don’t have the time or skill to create a Globex trading plan with EDGE then let’s get you started!

Join me tomorrow at 10:00 AM ET for Lookback (5). In this 90-minute Zoom ses...

The Daily Market Forecast

Today’s Lesson: The Power of Review

Join me on Saturday morning @ 10:00 ET to watch as we review every trade taken in our trading room this week… S&P, Gold & Oil futures. Winners, losers, break-evens, all will be analyzed.

You can meet some of the team and get your questions answered. Click here to reserve your seat.

For Thu 211028 (Plenty can change by the open, be aware.)

Globex Review: No trades triggered yet in a narrow range-bound market.

Day Session Analysis: Sentiment is mixed leaning bearish. Stats are mixed. Jobless Claims & GDP will determine the early trend. Willing to trade either direction under Alt1 stop movement UNLESS/UNTIL the Globex range increases plenty OR the expected move of the SPXW is wide. Thursday (both sessions combined) garnered ONLY 4% of all the gains over the past 5 years in dollars. Breakouts (95%) crush Reversals (5%). Consider not trading Volume Profile. Trading ES/CL/GC using Vol Rev with filters (download the new Edge). Looking to establish a cr...

The Daily Market Forecast... Lesson Day

Today’s Lesson: Winning streaks.

Yesterday was the perfect day… 6 trades all winners trading the S&P, Gold and Oil. The buy at 4560.75 for the S&P caught the exact bottom (read the September 24th blog to understand WHY you should always buy ON the proximal line moving your stop IN if need be).

Everyone enjoys winning streaks and no one knows when they’ll end. But they do.

How many wins in a row is likely? What is the probability? There is a simple mathematical formula to help visualize this called Theory of Runs. You only need two data points to determine the odds of the next trade being a winner: Total number of trades (sample size) and historical win percentage.

Before you shake your head when you read what the win percentage is for our strategies you need to know that breakeven trades are counted as “wins” simply because they are not losses. It’s a reframing technique to help your personal trading psychology. The number is around 60% depending on the asset.

Given the 60% win ra...

The Daily Market Forecast... Lesson Day

Today’s Lesson: Fresh look at time.

Day traders are generally aware that time of day can matter. Sometimes, it matters a whole lot… like don’t bother trading during certain times.

One of the stats you should be keeping is time of entry. If you trade the Globex (and you should) use the 24-hour “Military” convention for record keeping.

Document several hundred trades (more is better, but you can also back-test to capture this data). Make sure you’re also capturing the gain/loss amount, long/short, and if applicable reversal/breakout.

Here’s an eye-opening trick: If you entered this in a spreadsheet you probably have it sorted by Date and then Time. Re-sort the data ignoring the Date and only by Time. Now, all the trades around certain times of day will be together on the spreadsheet.

Create a chart with Time on the X-axis and Gain/Loss on the Y-axis.

One strategy I trade has reversals and breakouts. Doing this we found some very revealing evidence (sample size for this analysis was...

The Daily Market Forecast... Lesson Day

Today’s Lesson: Move Stop or Not?

Blindly saying “never move your stop” is saying market conditions don’t change, which makes no sense at all.

In our trading room we find that aggressive stop movement is warranted in certain market conditions. Slow stop movement is warranted in other conditions. NOT moving the stop is flat-out WORSE (both mathematically AND psychologically).

Let’s define the difference between “aggressive” and “slow” stop movement. Using our strategy rules the aggressive rules move the stop to breakeven for the trade itself after target 1 is filled, and to breakeven for remaining contracts after target 2 is filled.

Our slow rules move the stop to a trailing pivot after target 2 is filled.

Choice depends on market conditions. A trending market deserves time and patience. Use the slow method. A choppy market requires fast reaction. Use the aggressive method.

Using Friday’s suggested levels (chart above) the difference in the three methods is huge. Trading 3 contrac...

The Daily Market Forecast... Payday Theory

Today’s Lesson: Payday Friday

If you’re like most retail traders you are focused on growing your trading account so you can increase your risk and ultimately your expected reward. Taking a “paycheck” from your trading account seems like taking a step backward.

The trading account is intangible. The figures on the statement don’t mean the same to you as a tangible reward. Psychologically, you NEED to be rewarded for a job well done. Make those wins REAL.

Here’s a simple trick for getting paid, growing your account, and improving your trading skills simultaneously:

- Determine your payday (weekly, bi-weekly, monthly).

- Log your trading account balance at the start.

- On payday calculate your gain/loss in the account.

- Pay yourself a pre-determined percentage of the gain. Take nothing if you lost.

If you’re more interested in growing the account make the percentage small, maybe 10% or 20% of the gain. Even though the actual paycheck may be small, when you spend it on something tangi...